- 07 Feb 2024

- Print

- DarkLight

- PDF

Company car taxes

- Updated on 07 Feb 2024

- Print

- DarkLight

- PDF

Company car taxes (TVS)

With effect from 1 January 2022, the tax on company cars (TVS) will disappear and be transformed into two annual taxes to be paid in January 2023. The principles remain the same, only the method of calculation has changed. It will now be calculated on the basis of the exact number of days the vehicle is in your possession, rather than on a quarterly basis (it is possible to keep the quarterly calculation until 2025).

The 2 new taxes are as follows:

- Annual tax on CO2 emissions

- Annual tax on emissions of atmospheric pollutants

To access the new emissions taxes, follow these steps:

Access to emissions taxes

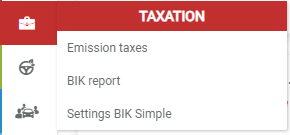

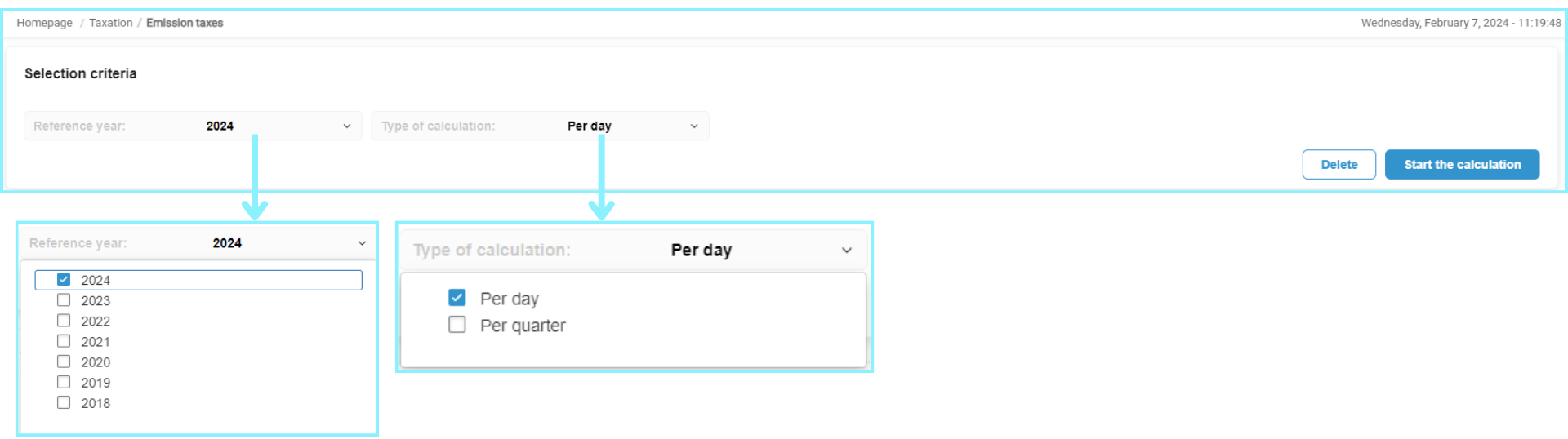

On the platform, in the drop-down menu on the left of your screen, click on Taxation then Emissions taxes.

Select the reference year you wish to view and the type of calculation.

Click on the "Start calculation" button. Two new blocks are displayed: the summary and the details.

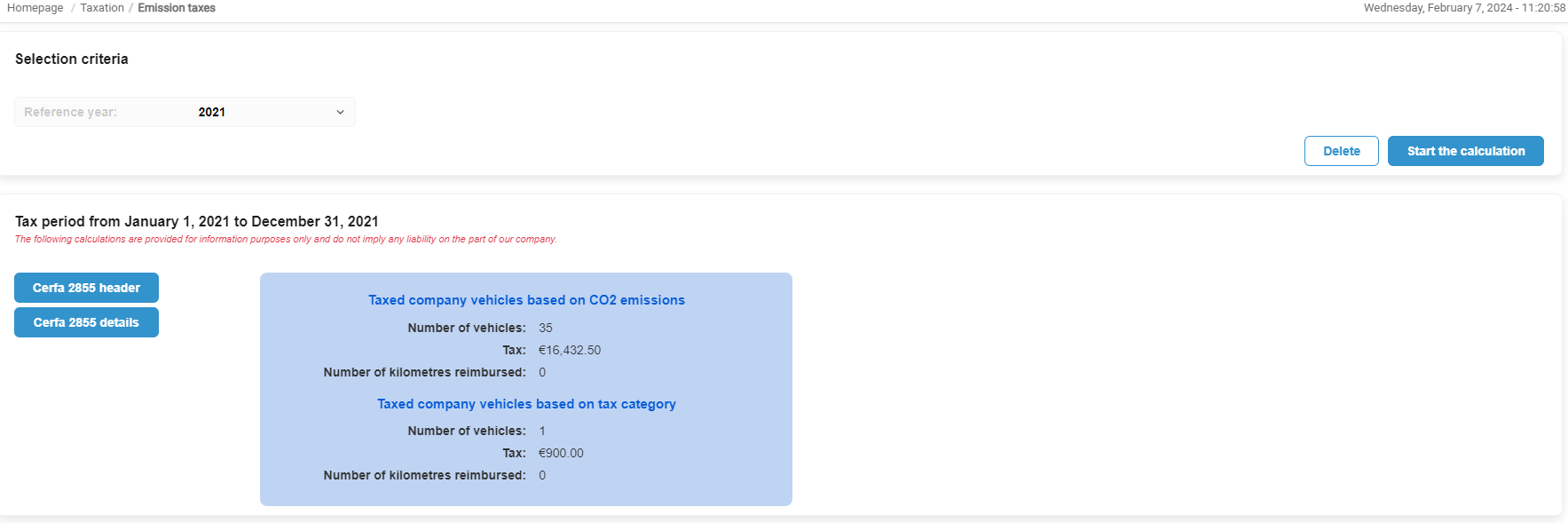

Below is an example for the year 2021, i.e. before the change in the TVS calculation method.

The summary block for years prior to 2022 contains a summary of the amount of TVS for the year chosen, as well as the related Cerfa forms.

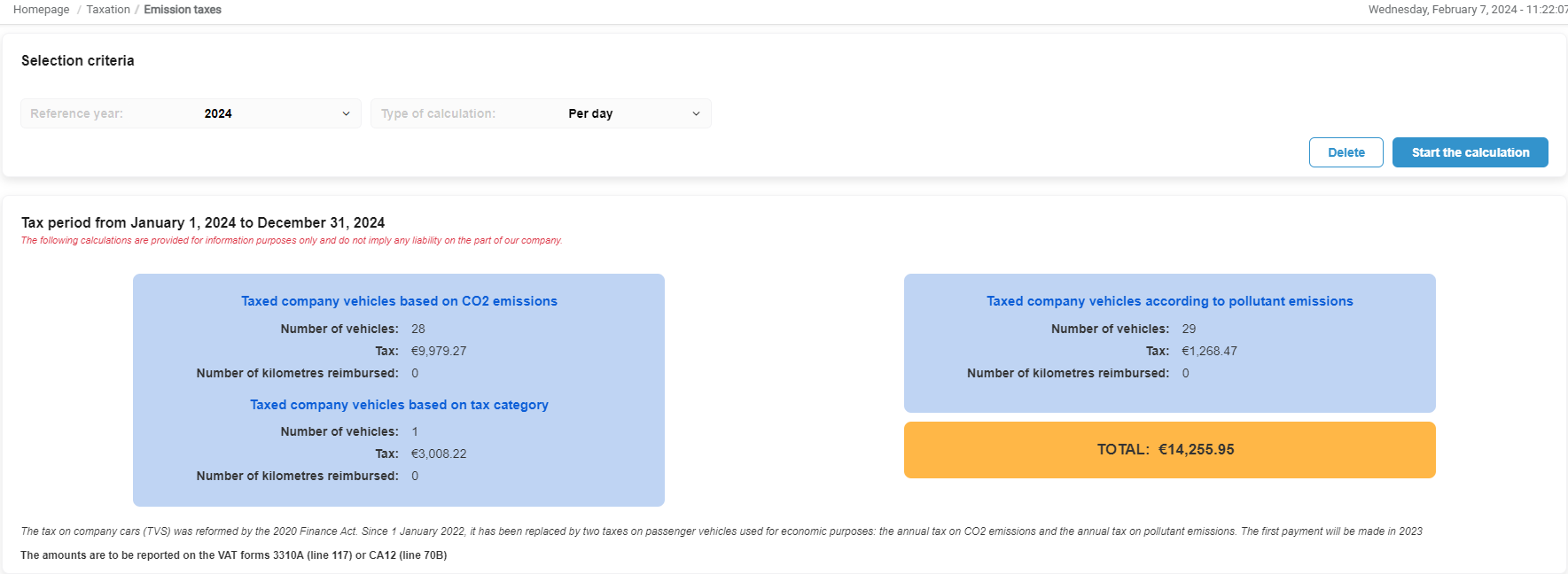

Below is an example for the year 2024, i.e. after the change in the TVS calculation method.

The summary block for the years 2022 and onwards contains a summary of the amounts of each of the 2 new taxes, as well as the sum of the 2 taxes (there is no Cerfa form for these taxes at the moment).

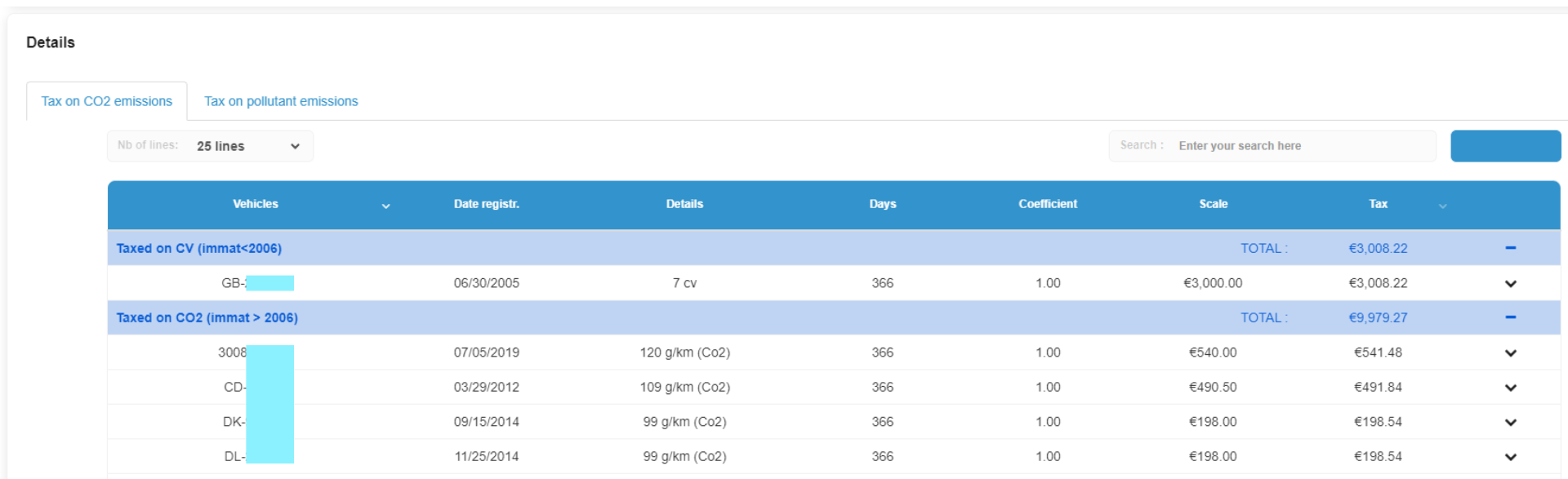

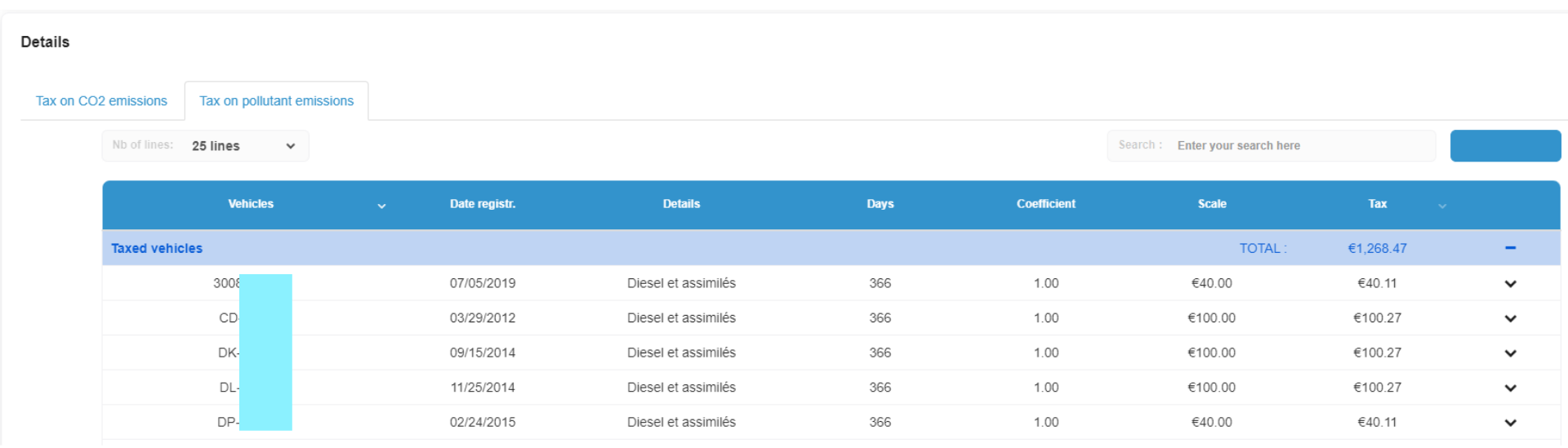

Below this summary block, you will find details of taxes on CO2 emissions and taxes on pollutant emissions. The filters (day, quarter) applied in the first block are reflected here.

You can now download this data in .csv format.